The Real Electric Vehicle Sales Numbers—and The Difficult Questions They Raise

This article was written by Jennifer Dungs, EIT InnoEnergy Thematic Leader, Energy for Transport and Mobility, and was initially published on Forbes.com.

People are buying EVs in record numbers. What does this mean for car infrastructure?

Buckle up, the transition to electric cars is accelerating at a pace that was not predicted even six months ago. In December 2021, for the first time ever, sales of fully electric cars in Europe were higher than those of diesel cars. Tesla broke another record, delivering 309,000 electric cars in Q4 2021, a 71% increase as compared to Q4 2020. In Norway, 2 out of every three cars sold were electric in 2021 and that ratio is expected to reach four out of five in 2022. Europe has reached the tipping point and seven automotive brands have already committed to 100% electric car sales by 2030.

In the U.S. the car market is still focused on gasoline-powered cars but, with stricter fuel economy standards, 50%-65% of new vehicles sold will be battery electric by 2030. The U.S. OEMs have additionally declared a ban on gasoline powered cars by 2035. This move will affect the re-sale value and could further accelerate electric car adoption. The tides are shifting. And electric cars were front and centre with positive product placement during the recent Superbowl. A record seven electric car advertisements were shown, versus two from gasoline-powered.

This surge in take-up of electric vehicles creates an equally growing need for new charging infrastructure. BNEF reported that more than 6.6 million electric cars were sold in total in 2021 and anticipates that number to jump to 10.5 million in 2022. Estimates based on automaker commitments are 40 million electric cars sold per year by 2030. To support this transition, it is estimated that 15,000 chargers need to be installed every week by 2030 in Europe and nearly the same in the US! A massive undertaking that will not happen overnight.

Will new electric cars hit the streets regardless of the infrastructure?

For the short and mid-term, this raises the question: will new electric cars hit the streets regardless of the infrastructure? Or will new buyers look to see whether the charging stations they need are already there—and all the drivers with range anxiety will hit the brakes?

To find out, 4 out of the 5 “W” questions need to be answered: who is charging, when are they charging, where, and why? An urbanite or a homeowner? Do they need a fast-charger (150 kW) or a normal one (7-22 kW), and do they try to “top-off” every day or wait until their charge is at 10%?

A few things are certain. People will not charge cars way they used to. In fact, the need for charging at a traditional gas station will significantly decrease.

Recently, a claim circulated widely that all US gas stations would require 600 50-kW chargers at an estimated cost of $24 million at each station. It was quickly proven false by Jessica Trancik and Ian Miller of MIT, but not before it was reshared/retweeted across social media. At this point in the transition there is still a lack of understanding on how and where people will charge. The social media claim assumed that people would charge exactly the way they did when fuelling a gasoline car. But electricity is available everywhere, unlike gasoline. With the various options for charging at home, work, or while shopping, the gas station will become only one of many options.

At the same time, in January, Shell launched an electric car charging hub in West London, replacing its petrol and diesel pumps with 9 fast-chargers (175kW) which can charge electric cars to 80% in less than 10 minutes. So, traditional gas stations are not yet out of the game!

The key, however, is that people favour convenience, so charging infrastructure will need to meet drivers’ where they are, whether at home, at work, or at leisure.

The benefits of electric cars are clear. They can reduce average lifetime emissions, as compared to gasoline/petrol cars, by 65% if most of the electricity generation is from the average energy mix, and by up to 83% when charging with entirely green electricity. Meanwhile electric cars continue to become even more efficient, and electricity generation will become less carbon intensive, creating even more of a positive impact. And most important of all, people want them. Across the US and Europe, drivers are switching to electric cars faster than ever.

Now the question is, are Europe and the US ready to deliver the charging infrastructure EV drivers need, and how can they do it best—to last? I’ll be doing a deep dive on this soon.

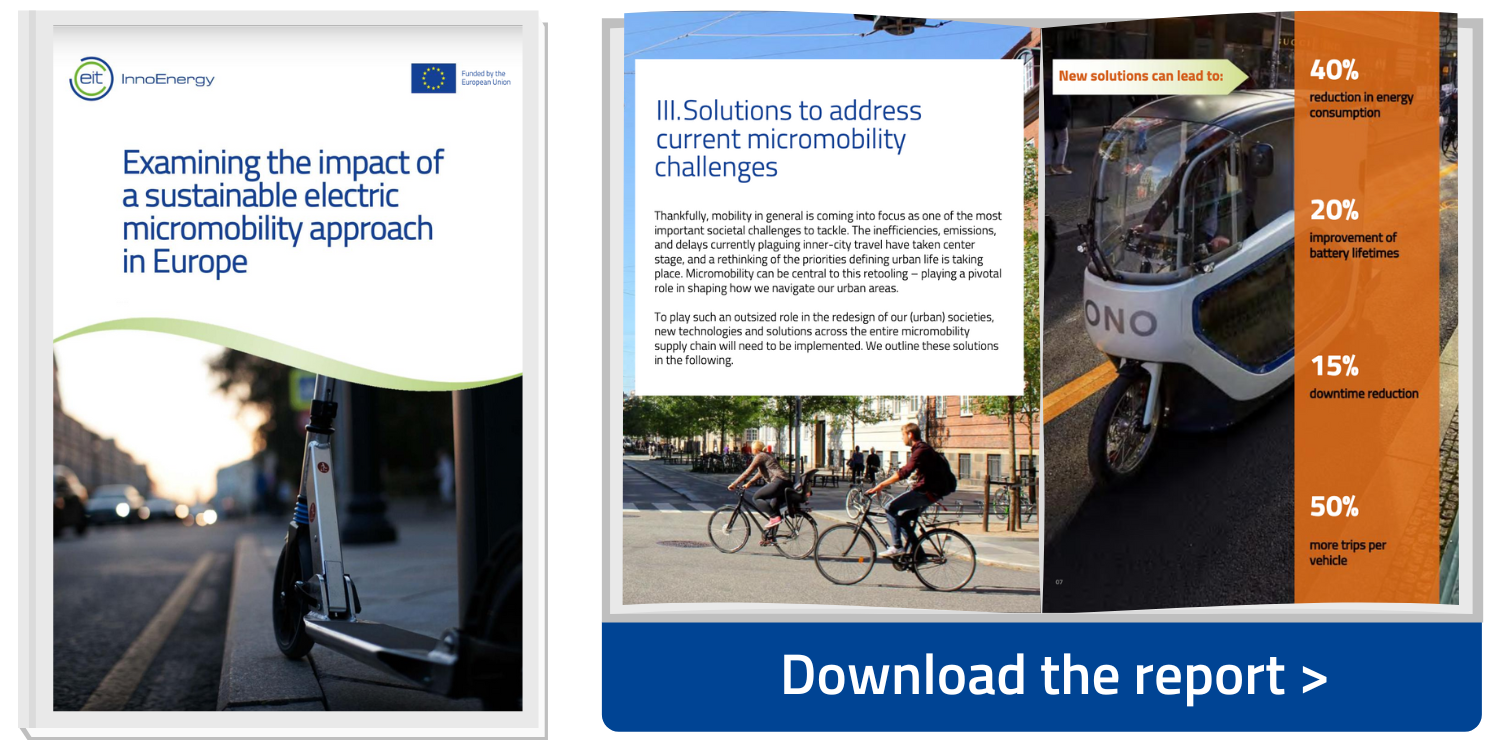

Explore the challenges facing electric micromobility today as well as possible solutions for a sustainable and coherent micromobility approach in Europe. Download the report ‘Examining the impact of a sustainable electric micromobility approach in Europe’.